Step-by-Step Guide to Online Trading in India

Online trading in India has seen a significant increase over the years, as more individuals are opting for this convenient and efficient way of investing. With the evolution of technology, online trading has become easier than ever before, and it’s no surprise that many people want to learn how to navigate the stock market and start investing in stocks. To help get you started, this step-by-step guide to online trading in India will help you achieve online trading success.

Step 1: Determine your investment goals

The first step in online trading is to determine why you want to invest in the stock market. Is it to earn a passive income or save for long-term goals like retirement? Once you establish your investment goals, you can determine your investment strategy and the types of stocks you want to invest in.

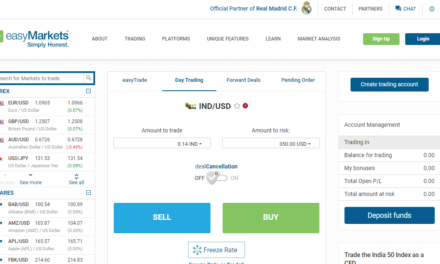

Step 2: Select an online trading platform

Selecting an online trading platform is a crucial decision when it comes to online trading. The platform should be secure, user-friendly, and offer a variety of trading options. Popular online trading platforms in India include Zerodha, Angel Broking, and Upstox, among others. Take the time to research and choose a platform that suits your needs and investment goals.

Step 3: Open your trading account

Once you select an online trading platform, you need to open a trading account with it. Once the account is created, the trading platform will provide you with login credentials. After logging in, you will be prompted to complete a Know Your Customer (KYC) process to verify your identity before you can start trading.

Step 4: Fund your account

After completing the KYC process, you need to fund your trading account before you can start trading. Most online trading platforms provide numerous options to fund your account, including debit card, net banking, and UPI.

Step 5: Research stocks

Before investing in a stock, it’s essential to research it thoroughly. You can research stocks by reading news articles, financial reports, and analyst recommendations. Online trading platforms also offer research tools that can help you analyze stocks and make informed decisions.

Step 6: Place your trade order

Once you’ve researched and selected a stock to invest in, you can place your trade order. There are two main types of orders: market orders and limit orders. With a market order, you buy or sell a stock immediately at the current market price, while a limit order allows you to set a specific price at which you want to buy or sell a stock.

Step 7: Monitor your investments

Once you’ve invested in a stock, it’s crucial to monitor it regularly to keep track of its performance. Most online trading platforms provide a portfolio tracker that allows you to monitor your investments in real-time.

Final thoughts

Online trading can be a great way to invest in stocks and earn a passive income. However, it’s essential to do your research and follow the above steps to ensure your success. Remember to select a reliable online trading platform, conduct thorough research before investing, and monitor your investments regularly. With these steps, you are sure to achieve online trading success.